Texas title loan regulations prioritize security and transparency for both lenders and borrowers through specific license requirements. Lenders must verify their licenses, assess borrower eligibility, understand interest rates, and navigate online applications, while borrowers gain access to reputable, licensed providers ensuring fair transactions. Non-compliance with Texas title loan license requirements leads to severe penalties, underscoring the importance of adherence for legal and ethical operations.

In the competitive landscape of Texas’s financial services, understanding and adhering to title loan regulations is paramount. This article guides lenders through the process of verifying crucial Texas title loan license requirements, ensuring compliance with state laws. We explore key aspects such as obtaining and verifying licenses, maintaining ongoing compliance, and best practices for navigating this stringent regulatory environment. By following these steps, lenders can avoid legal pitfalls and foster robust, ethical lending practices in Texas.

- Understanding Texas Title Loan Regulations

- Obtaining and Verifying Licenses

- Maintaining Compliance for Lenders

Understanding Texas Title Loan Regulations

Texas title loan regulations are designed to protect both lenders and borrowers. Understanding these regulations is crucial when considering a title loan in Texas. Key aspects include verifying the lender’s license, assessing your loan eligibility based on vehicle ownership and repayment capacity, and comprehending the terms and conditions associated with the loan, such as interest rates and fees.

Knowing how to navigate these requirements can help ensure a secure and transparent transaction. An essential step is to verify the Texas title loan license requirements by checking with the appropriate regulatory bodies. Additionally, exploring options for an online application and understanding the process of title transfer can make the borrowing experience smoother. These measures not only safeguard your interests but also provide clarity throughout the entire process.

Obtaining and Verifying Licenses

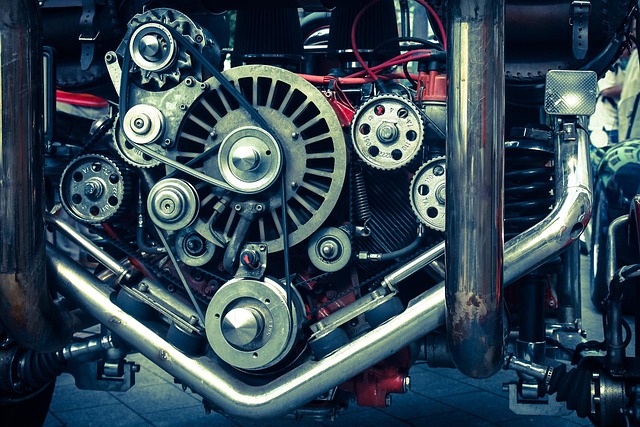

To ensure compliance with state regulations, individuals seeking to offer Texas title loan services must obtain and verify specific licenses. This process involves registering with the appropriate regulatory bodies and providing relevant documentation to establish legitimacy. Applicants should gather necessary paperwork, including business permits, identification documents, and evidence of insurance, to streamline the licensing procedure.

Verifying these licenses is crucial for both lenders and borrowers. It ensures that the lender operates within legal boundaries, offering transparent terms and fair payment plans. At the same time, it empowers borrowers by confirming that they are dealing with a licensed and reputable provider, allowing them to make informed decisions while accessing fast cash when needed.

Maintaining Compliance for Lenders

Maintaining compliance with Texas title loan license requirements is non-negotiable for lenders looking to operate within the state’s regulatory framework. These regulations are designed to protect borrowers from predatory lending practices and ensure fair, transparent transactions. Lenders must obtain the necessary licenses, adhere to specific guidelines regarding interest rates, terms of repayment, and conduct thorough credit checks before extending any loans. Failure to comply can result in severe penalties, including legal action and loss of operating permits.

A key aspect of this compliance is assessing and verifying a borrower’s ability to repay, often through a credit check. While bad credit loans are available, lenders must still assess an individual’s financial health, especially when leveraging the security of a vehicle through equity-based lending. By adhering to these requirements, Texas title loan lenders can offer necessary financial assistance while maintaining the integrity of their operations and safeguarding consumer rights.

When navigating the complex landscape of Texas title loan regulations, understanding and adhering to the specific license requirements is paramount. By obtaining and verifying necessary licenses, lenders can ensure compliance with state laws, fostering a transparent and fair lending environment for all involved. Regularly reviewing and updating practices to maintain compliance is crucial in this evolving regulatory space, ensuring that Texas residents have access to responsible and regulated title loan services.